Pressure Washing Insurance: The Complete Contractors Guide

Now that you’ve started a pressure washing business, you’ll want to protect it (and yourself) by purchasing the correct type of insurance.

The cost of pressure washing insurance makes sense because:

- You’ll have financial protection in case you damage property or get sued – If you’re pressure cleaning a house and property gets damaged (accident involving flying debris, chemicals killing garden plants etc.) the liability insurance will cover the repair.

- You’ll win more jobs (commercial and residential) – 64% of people we surveyed said they would only hire pressure washing services that are insured. The number rose to 87% when told they (not the uninsured contractor) would be liable if property got damaged. Use this info to your advantage… Put details of your top-notch insurance cover in your marketing flyers to increase trust.

- It’s affordable – 1 year of workers comp, liability and equipment insurance will only cost you 2 – 3 days revenue (and you get to spread that over instalments). Heck, it pays for itself in reduced anxiety alone. More details on insurance costs below.

PressureWashr has done 64 hours of research and compiled everything into this guide to help you understand everything about a pressure cleaning company’s insurance needs. So let’s dive right in:

Quick Jump Links:

- Grab your free quote

- Insurance terms to know

- The benefits of insurance

- 7 relevant types of coverage

- How much does it cost on average?

- What about cover for my mowing services?

- The best pressure washing insurance options available

Grab Your Free Quote Today

There’s a big difference between cheapest (least $) and best value (bang for your buck).

…And this is as true for insurance as it is for used cars, lawyers and contractors. What you want is the best bang for your buck – the best value. Because even if it costs more now it’ll save you $$$ in the longterm.

Grab a quick quote from one of the best value insurers below. The below 3 providers are the most trusted and talked about in industry forums.

We’ve filled out all the quote forms linked to below and the average completion time was 6 minutes. PressureWashr may be compensated through the links in the post below, but the opinions are our own.

Most Mentioned Providers in Power Washing Industry Forums

We went through 100s of forum threads (with 1000s of combined responses) about “what insurance provider you use” to discover which have the most buzz. These were/are the most talked about:

1. Joseph D. Walters.com

Having served as a broker for the pressure washing industry for over 30 years, the team at J.D. Walters is experienced and ready to help protect your business.

Joe has a deep knowledge of the industry, having co-founded the Power Washers of North America (PWNA) organization.

At the very least, they are good starting point.

2. Hiscox

Hiscox has been around since 1901 and currently has a revenue of over $3 billion showing they are a stable and strong company.

Hiscox specializes in small business insurance (companies with less than 10 employees) and they offer coverage in 49 states.

You can grab a quote from them today in less than 5 minutes by giving them your aprox. payroll, location and class of business (janitorial/exterior cleaning services is the common one for pressure washing contractors).

3. Erie Insurance

Erie offers the full-range of coverages and issues policies through their extensive network of 121,000 local agents.

When you go to request a quote, you’ll first have to search by ZIP to find a licensed agent near you.

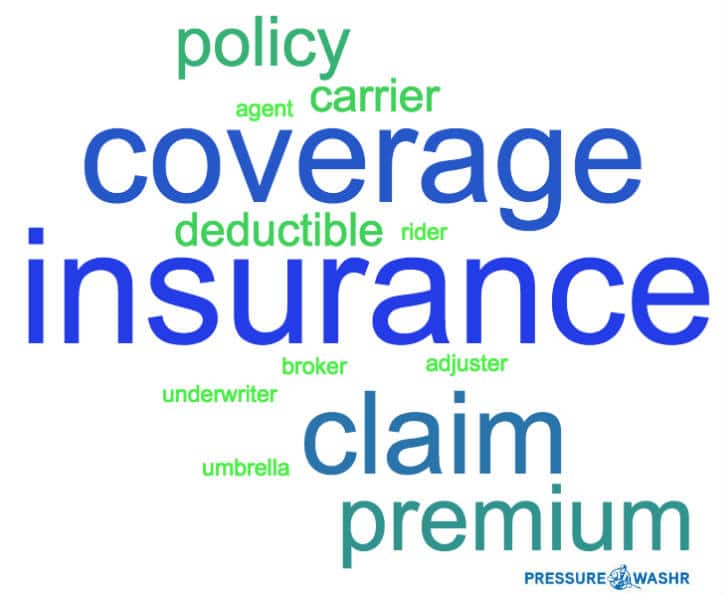

12 Insurance Terms You Should Know

- Policy – The written contract with the terms and conditions of your insurance.

- Coverage – The extent of protection.

- Carrier – The insurer.

- Premium – The amount you pay to the insurer either monthly, quarterly or yearly for your coverage.

- Claim – Asking the insurer to pay you when something you’re covered for happens.

- Deductible – What you pay to make a claim.

- Underwriter – The 3rd party or in-house entity that set the premiums you will pay. They assess the risk using a combination of data, software and mathematical models.

- Agent – Sells you policies from the company they work for.

- Broker – Looks at policies of many different companies and sells you the best one for your needs.

- Sometimes ‘agent’ and ‘broker’ both just mean: Someone who sells insurance.

- Adjuster – The person who decides how much money you get if you make a claim – the investigator.

- Rider – An addition to your standard policy.

- Umbrella Cover – Extra liability protection. You may have $1 million of general liability and the umbrella cover will cover an additional agreed upon amount.

3 Benefits of Pressure Washing Insurance

Insurance is protection:

- You pay a small regular premium to an insurance carrier and in return you get a guarantee of payout if a future bad event happens. Could be car crash, workplace fire, equipment theft, client property damage and other agreed upon events.

All mobile pressure cleaning contractors – whether commercial or residential – should take out policies for these 3 reasons:

You Get Money If Something Bad Happens

Think about this: You wake up in the morning, make your coffee and head to the computer to check your schedule for the day. You see you have 2 jobs – both on the other side of town – 35 minutes from your house and its at the base of the local mountain.

You know it rains a ton more there so you check the weather. Yup, 85% chance of moderate rain. Even though it’s not raining now, you be sure to chuck your rain jacket and waterproof boots in the back seat for insurance – just in case it does rain.

A rain jacket is insurance in case a future event (rain). The rain jacket is risk reduction and protection. This is the same thing as insurance for your power washing company.

How Insurance Covers Your Losses:

- In case your pressure washer small engine blows up. Now here’s the thing: You’ll need to agree with your insurance carrier what is included in your equipment and income insurance. Usually, the insurance will only cover lost wages and current value of machine at date of policy (not replacement value at time of failure).

- In case you get sued. Let’s say you’re pressure washing the concrete out front a gas station at night. You’re cleaning the curb close to the front window where the cashier looks out to the pumps. All of a sudden you hear a loud quick bang. Then slower but noticeable cracking sound. Crap, you think. The water jet stream has turned a marble sized rock into a bullet and broken/cracked the front window of the gas station. The replacement is several thousand bucks. Thankfully you have liability insurance to cover this exact accident. Phew.

- In case you get injured. You’re at the end of the day and week (it’s Saturday 5pm). Tired, sweaty and eager to get home. You’re rushing loading up the truck, lose focus and bend over with the back (instead of squatting down with the legs) to lift the surface cleaner… Your back tweaks out and you wrench in pain. You know immediately you will be out of commission for at least two weeks. With the right workers compensation and income insurance, you’ll be protected and money for food, mortgage and else will continue rolling in.

You’ll Win More Jobs Because You’re More Trustworthy

Would you hire an uninsured contractor to install underfloor heating in your home’s new extension? What about a plumber coming to plumb in your new clothes washer in the new and updated laundry room? Probably not, right?

Tell people about your insurance and coverage in your advertising to increase trust.

Here’s 3 tips to further increase trust:

- Go into detail about your insurance policy. Most pressure washing flyers will say “fully insured” or “$2 million insurance” or “licensed and insured”. To separate your flyers from the pack you only need to add an extra sentence or 2.

- In a section of your flyer use the title “We Are Accident Proof”.

- Below it say you have x-years experience and have never had to use your liability insurance but you still pay $x per month for ultimate protection, because accidents happen.

- In a tiny paragraph you have shown to be good at your job (haven’t broken clients stuff) and smart/responsible (still pay for protection because you know accidents happen).

- In your flyers talk about how you’re an “all-in” business. In addition to talking about your insurance policy/carrier/agent, talk about your equipment, trailer and power washing accessories. Talk about how they’re the best available to ensure you do the best work fast. Yes, there’s only so much room on a flyer, but adding trust is more than just showing a before after picture of house siding. Pick your favorite bit of gear ($500 surface cleaner. $400 extension wand, brand new trailer rig) and highlight some details and how it will do the job better.

- Give customers piece of mind – show off your insurance certificate. Any potential client will have reservations about your service straight away after looking at your flyer… Show them you’re insured, take credit card and can clean the surface better and faster than they can by adding these to your flyer:

- Image of your insurance certificate and details

- Show images of all the credit cards you take

- Show images of past jobs and have testimonials with pictures of the people.

You Can Bid on Beefy Commercial Jobs

If you have insurance you can increase your prospective client pool. No insurance and you can’t do commercial jobs and most home owners won’t hire you. With insurance, commercial jobs open up and with contractor’s bond you can advertize a guarantee without hesitation. These commercial jobs are often recurring (weekly) and nothing beats guaranteed cashflow.

7 Types of Insurance Coverage for Mobile Power Washing Contractors

Let’s look how different types of insurance apply to your power cleaning day-to-day tasks:

1. Liability Insurance

Don’t go bankrupt if you damage client property and get sued

This is probably the most obvious type of insurance you’ll want. It protects you if found legally responsible for harm/damage you cause to people or property. Be sure your policy includes “Care, Custody & Control” coverage.

Example claim: You’re pressure washing a driveway and the nozzle pops off, bounces off the ground and breaks a nearby car window. You’ll have to pay the deductible to claim the losses.

2. Property Insurance

Protect your place of work and its contents

Do you operate out of your home garage? You’ll probably need separate/more cover than your regular home and contents insurance.

Do you operate from a dedicated building/workshop only used for pressure washing operations? You’ll need property coverage in case of fire, theft or maybe even earthquake or flood.

Example claim: The workshop space you rent has an electrical fire and the place goes up in flames destroying many of your supplies and paperwork.

3. Equipment Insurance

Cover your equipment while on the job-site

Most power washing contractors are mobile and go to multiple job sites per day. Property insurance will usually only cover your equipment when it’s at the home office or your workshop. Standalone equipment insurance is what you’ll need to protect against theft, damage and breakdown while at the different cleaning locations. Also, if you rent equipment, find out if it’s covered.

Example claim: You’re going about your duties pressure cleaning a commercial building when you hear a weird loud bang come from the triplex pump and the water stops flowing. You figure out that a piston has cracked requiring a pump replacement/repair.

4. Income Protection

Keep paying your mortgage and feeding your family even if you get a disabling injury outside the workplace

Income protection, sometimes called disability insurance, protects you against the risk of injury happening outside the workplace (physical or psychological) whereby you can no longer fulfil your pressure washing duties.

This type of protection is probably the least asked about and least bought because people think workers’ comp is all the coverage they need. However, workers’ comp only covers you for injuries that occur while you are working. According to DisabilityInsurance.org 1 in 4 people in the US will experience a disabling injury before they retire, losing income for a period of time if they don’t have income protection… So be sure to ask about it.

Example claim: It’s the weekend and you’re in your backyard building a treehouse with your kids. You go to lift an 8-foot long 2″ x 4″ to act a the floor beam and your back gives out causing you pain. You end up missing 3 weeks of work/income so you make a claim for those lost wages.

5. Workers’ Compensation Insurance

Protect your employees while they’re working

Workers’ compensation protects employees (and you) from lost wages if injured at work and not able to return short term. If you need coverage for injury when doing work around the house – that’s income/disability insurance.

Example claim: You are reaching around for the chemicals in the back of your trailer and your arm rubs against the hot water power washer’s burner badly burning your arm. You get treated at the hospital and the doc tells you will miss at least 2 weeks work. The medical and lost income is what you claim under your Workers’ Compensation.

6. Commercial Auto Insurance

Protect your vehicles

This type of insurance most people know about and have it for their car or truck. You pay a premium, usually each year, and if you get in a car accident (and it’s your fault) the insurance pays for the damage repair.

With regards to a pressure washing work truck(s) auto protection you will need extra coverage since you use it more and have a need to protect it more than your weekend Honda get-around car.

Example claim: It’s been pouring rain all-day and you’re driving to your next job. You are going the speed limit but a few cars ahead of you they slam on the brakes causing a chain reaction of cars in front of you slamming on their brakes. It’s too late and before you come to full stop you have crashed into the car in front of you causing minor damage to both cars. You’ll need to pay deductible and make a claim.

7. Contractor’s Bond

Have a 3rd party guarantee your work

A contractor’s bond gives piece of mind to the customer and assures them of project completion. If the project is not completed as per the contract, the bond owner (often a government entity), works to ensure the project is completed by another means or the customer is compensated accordingly. These bonds are required if a job exceeds a certain value (depending on state but usually anything above $5,000) and if your customer is the state, and often if the contract is on private property.

Frequently Asked Questions:

Should You Use a Single or Multiple Carriers for Your Policies?

It’s up to you.

Get quotes from 3 companies and compare them for value for money.

Many carriers will bundle the above insurances into one policy making it simple. You shouldn’t need to get a different policy for each type of insurance you require. However, you may need to get coverage from multiple carriers…

…For example, one carrier holds your auto insurance, one your workers comp and the other your liability, property and equipment. Knowing if you need to do this will be easy to find out because one may not offer the protection you want… Or another may be much better value (cheaper premium and better payout).

What is a Business Owners Policy (BOP)?

It’s a bundle of coverages to make things easy for small businesses. Instead of taking the 4 or 5 different policies you need you just get the BOP bundle and add riders as needed. It’s usually a good deal and something to ask your broker about.

Do You Need a Business License? Is That From The Insurer?

Yes you need a license. No, it is not from the insurer. The general business license you need will be from your local government and acts as a registration telling them you are operating in the jurisdiction. It allows the gov’t to track for tax purposes. It will cost you an annual fee, most likely.

How Do You Prove You’re Insured?

You might have a situation where you need to prove you have a certain type and amount of coverage before you can submit a quote or be rewarded a contract.

Often, your original policy documents will be enough information to satisfy the customer as long as those originals include your Certificate of Insurance, which details the following:

- Insurer

- Policy number

- Policy start and end dates

- Amount of liability coverage.

This document is usually free up to a certain number of copies – be sure to request it included with your original documents.

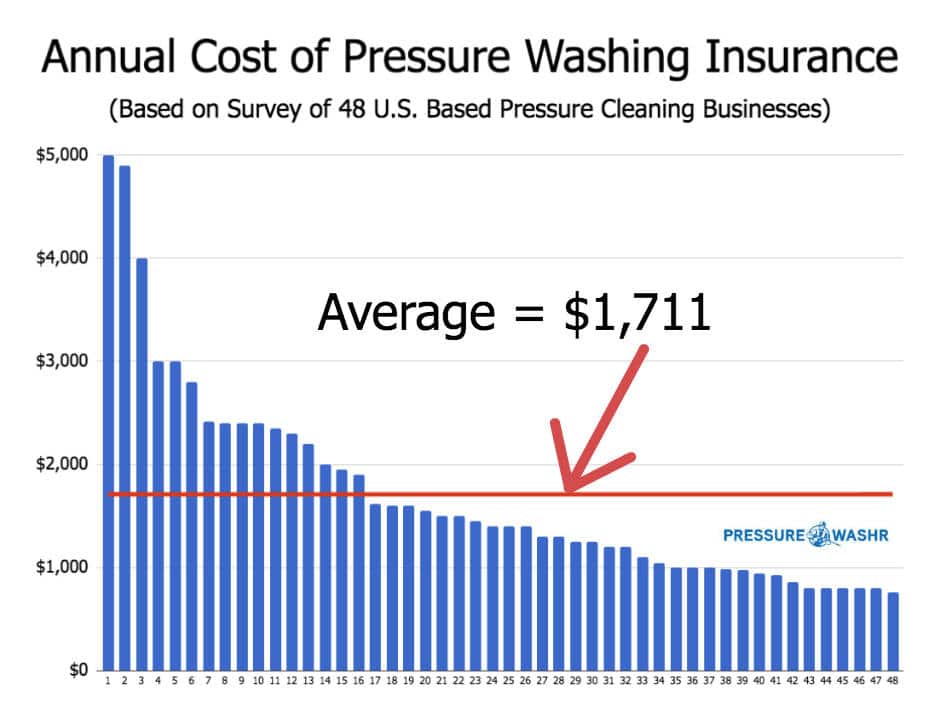

How Much Does Pressure Washing Insurance Cost?

Cost varies widely from contractor-to-contractor, policy-to-policy, state-to-state and carrier-to-carrier… So in the below chart you’ll see the best average we could manage.

PressureWashr surveyed 48 operating pressure cleaning businesses to find the average cost they are paying for insurance. Some responded with their total cost across all policies/carriers and some with only their general liability (GL) premiums cost.

The businesses:

- Were from 19 different states

- Had GL coverage ranging from $300,000 to $5 million

- Had payroll (number often used by insurers to scale premiums) ranging from $42,512 to $425,292

- Around 55% had policies with at least one other insurer (liability and equipment cover at one and workers comp, commercial auto etc. at another, for example).

Chart Showing Insurance Average Annual Cost:

Note About Chart:

The top 3 highest and bottom 3 lowest costs paid for liability insurance were dropped from the data to create a better more accurate average. This needed to be done because, for example, the highest paying respondent had $21,000 premium (9 employees and did high rise window cleaning in New York).

What Variables Change Cost of Coverage?

- How much protection you want. With equipment insurance, for example, do you want it to be covered for new replacement cost or cost it’s worth at time you take out policy? The premiums you pay will be higher to warranty it for an as-new replacement. Same with liability coverage: premiums will go up if you want $2 million protection instead of $500,000.

- How many employees you have, their experience in pressure cleaning industry and their pay. The more people doing pressure washing jobs around town on behalf of your biz each day means there’s more risk of damaging property (liability insurance premium goes up). If these employees have no or little experience – risk and premiums go up. The more they get paid the more coverage required to pay them in case of injury – premium goes up again.

- How much equipment you need insured. Do you have 3 trailer rigs each with a top-notch hot water power washer? Or just a single portable cold-water pressure washer? The less you have, the less risk the insurer is taking equals less premium for you to pay.

- Your gross sales. Are you a statewide business with multiple workshops or operating with one truck out of your back shed? Gross sales are the easiest indicator of how much work you’re completing.

- Your operations location. Are you in hurricane risk area? How high is the risk of flood? Are you in a crowded city with lots of risk (ie. New York)? Or are you in rural Arizona?

- Your claims history. Have you been in biz for 17 years and never filed a claim? Or have you been in biz 3 years and already filed 4 claims. Your insurer will take this history into account and likely charge lower premium to contractor with less claims history.

- The type of cleaning jobs you do. There are different insurance class codes that the broker/agent will use to calculate your premium. If you stick to ground level exterior building cleaning, for example, you pay much less than doing third-story windows and roofs. In fact, be careful to check because many insurers won’t cover restaurant exhaust hood cleaning, roof cleaning and anything above 2nd/3rd story.

What if You Also Offer Painting, Mowing and Window Cleaning Services?

The most common extra services pressure cleaning contractors offer are: Painting/paint removal/staining, landscaping and window cleaning.

If the underwriter has classed any of your extra services more risky than pressure cleaning your premium will go higher. However, the flip side of that is if you do 80% mowing jobs and 20% pressure cleaning, your premium may be lower since mowing grass has less risk than pressure cleaning homes.

The common insurance class codes the carriers use will be the same but the premiums they charge for each class may vary.

So to put it simply:

If you offer more than pressure washing services – yes – your insurance premiums may change. You may need to add umbrella cover or a rider to account for the extra services.

Artisan Contractors Insurance Classification Codes To Know About

Here are the common codes for artisan contractors doing pressure cleaning, painting, mowing and window cleaning work. The purpose of showing you these is so you can double check your broker/agent has matched your business up with the correct insurance premium class codes.

The relevant codes are below – You can search for yourself at SICCODE.com if you offer a service not listed here.

Standard Industrial Classification (SIC) Codes:

- Cleaning/janitorial: 1799, 4959, 7349

- Painting/staining/removal: 1721, 1799

- Mowing/landscaping: 0782, 0783

North American Industry Classification System (NAICS) Class:

- Cleaning/janitorial: 561790

- Painting/staining/removal: 238320

- Mowing/landscaping: 561730

Workers Comp Class Codes = National Council on Compensation Insurance (NCCI):

- Cleaning/janitorial: 9170

- Painting/staining/removal: 5474, 5476

- Mowing/landscaping: 0042 and 9102

The Best Insurance Options for Your Business:

There’s nothing wrong with getting free quotes online to get a rough idea how much money you’ll be paying for coverage. However, nothing competes with face-to-face discussions with your local broker.

Ron Musgraves is one of the utmost authority in the power washing industry and here’s what he has to say about insurance:

In this video Ron talks about the importance getting your policy written by a broker/agent that specializes in writing commercial policies – not one that does life, auto, health most of the time – one that does commercial business liability policies.

The Most Talked About Providers On Power Wash Industry Forums:

| Insurance company |  |  |  |

| Website |

More Hiscox Small Business Insurance Info:

Here’s why they’re rated 4.8 out of 5 by 9,798 paying contractors:

- Small business specialists: They focus on small business needs. This may be your first time purchasing insurance, and they know that. That’s why they make their quote process simple and quick. And they have licensed insurance agents ready to help you 14 hours per day Monday to Friday.

- Affordable: Because Hiscox focus on small businesses they know the risks involved and can hone in on the lowest premium they can offer. For this reason, depending on your company size and industry class, their average liability insurance cost is $30/month. However, they insure a large number of IT/Tech and business consultants who mostly do office work so expect to pay more as a power wash contractor.

- Simple claims process: If you need to make a claim you have 4 options: online, email, call or mail. Once you lodge, you’ll have a customer rep. within 2 days and if successful money in the bank within 2 weeks.

- Features: If you use a risk management system and track the risks of each job, Hiscox will reward you with lower rates. You can also receive discounts for grabbing multiple covers from Hiscox and if you run your business from home.

Compare Quotes From Multiple Insurers (Like Expedia for Flights But for Insurance):

| Company |  |  |

| Website |

Why Use Insureon.com or NetQuote.com?

If you want to save time and hassle then you’ll want to use one of these insurance comparison services. They work like Expedia does for flights and outputs multiple options (after you fill in form details) that suit your needs and allow you to compare in one place.

Sources

- Claims Reported in September. JosephDWalters.com.

- New, Improved Insurance Program for Power Wash Owners. May 5, 2013. www.eCleanMag.com.

- Business Owner Policy – BOP. Investopedia.com.

The regular size fine print:

- The information on this page is intended as a starting guide only. PressureWashr researchers have done their best to provide accurate information but the industry options are vast and you must also talk to your local specialist commercial insurance broker to get the most accurate guidance for your situation.

- Some of the links to insurance companies contain a tracking code. If you click the links with a tracking code and fill out the free quote, pressurewashr.com may receive a small commission. PressureWashr performed over 64 hours of research on finding the best insurance for power washers and decided on the company rankings before knowing the commission amounts.